If Bitcoin was Tesla

An imaginary comparison to better understand what is happening with Bitcoin these days (US ETF, halving etc)

It is not easy to understand what has recently been happening in the world of Bitcoin. To discuss it, let’s imagine instead that what happened to Bitcoin happened instead to Tesla.

Imagine a world where Tesla cannot build any more factories.

I don’t know why, but they are just not allowed anymore. Maybe there was a planetary coalition of all countries that decided to ban them from doing so. Maybe because Elon found and invited aliens to invade earth. Maybe that’s the reason.

Not only can’t Tesla build more factories, they are also obligated to shutdown half of their capacity every four years… Can you imagine that? Yikes!

The Musk army

But there is a very large user base in the US that adore Musk; they want him to be the next president. And so this group, in protest and in solidarity, started buying all the Tesla that they could. Not the Tesla stock; the cars. The Tesla cars.

Currently, Tesla’s factories worldwide can produce 900 new cars everyday. Those cars are still being sold in different countries around the world… but thank to that very strong fan base in the US, the demand there has now increased to 6,300 - 6,500 cars per day. Every day.

So in our imaginary, authoritarian world right now, the US demand alone is seven times bigger than the worldwide production capacity.

Bits of value; defusing and diffusing crypto information. A monthly newsletter and occasional tidbits. No AI, just pure dumb human intelligence.

So what happened next?

At first, Tesla prices went up a bit, but not too much, mostly because there was a large inventory of brand new cars sitting in the company’s parking lots around the world. They started redirecting that supply to the US to absorb the heightened demand.

After a while, the prices for used Tesla started going up. A lot.

Owners that had bought their car at 20,000$ or 25,000$ a year ago were happy to sell them for 40,000$! That’s a nice profit, ain’t it?

Maybe they thought that the situation was temporary, that it would correct itself and that they would be able to buy a new Tesla for cheaper in a year or two. (I don’t know what they thought, because I drive a pick-up truck. That uses gasoline. Yes, shame on me. Moving on…)

When no more new inventory was available from the parking lots worldwide, when everyone that wanted to sold their used Tesla had done so, that is when prices really started to go up.

Because, you know, the law of supply and demand.

And in this instance here, both sides of the law were pushing prices higher: supply has decreased while demand has increased equally drastically at the same time.

And it’s not over.

Next month, Tesla will face his next “halving deadline”

Once more, as per order of the planetary council, Tesla will have to cut their production by 50% again. They will be able to produce only 450 new cars per day. This will be the fourth time in the company’s history that they have to cut production by half. Every four years, they have to do it, no matter what. Like clockwork. Until the end of times…

(Don’t be sorry for people loosing their jobs by the way, because Tesla factories are all manned with humanoids.)

And that brings us to today

Looking ahead at the next few months, in this scenario, do you think that the prices of Tesla will stay the same? … Will they go up? Will they go down?

We don’t know the future, but we know that the decrease in supply is programmed; the daily production is fixed. Forever. We know the supply side. So the big unknowns reside around the demand side.

Maybe that fan base has been satisfied and every Tesla and Elon fan boy that wanted to own a Tesla has one. Maybe the movement is fading and the domestic US demand has was just a 1-year peak. And/or maybe the demand for Tesla in other countries is also decreasing for other reasons.

Could a decrease in demand outpace the programmed decrease in supply and bring prices down?

Bitcoin is Tesla in this story:

The massive increase in US domestic demand is the launch of US Bitcoin ETFs,

The programmed decrease in Tesla production is the bitcoin halving event,

The current daily production of bitcoin is 900, to be halved to 450 in April 2024,

The price of a bitcoin a year ago was around 20-25,000$. Many who bought at those prices sold at around 40,000$ in the first days post ETF launch (like in the story) and

The “parking lots” of sitting supply are over-the-counter (“OTC”) bitcoins that the US APs managed to source.

What’s an ETF by the way?

ETF means “I can now purchase bitcoins like I purchase stocks or mutual funds”.

It means US residents can simply call their bank, their advisor or log into whatever trading platform they use to easily, legally and officially buy bitcoin. They can buy from places and people they know. It’s accessible.

And it’s not just for Elon’s mom and veterans; it’s also for multi-billion funds. These funds can now hold bitcoin. And that is all a very big deal.

Napkin calculations

Let’s look at some numbers and put into some mathimaticalistic perspective what I described above. Three simple data points for you:

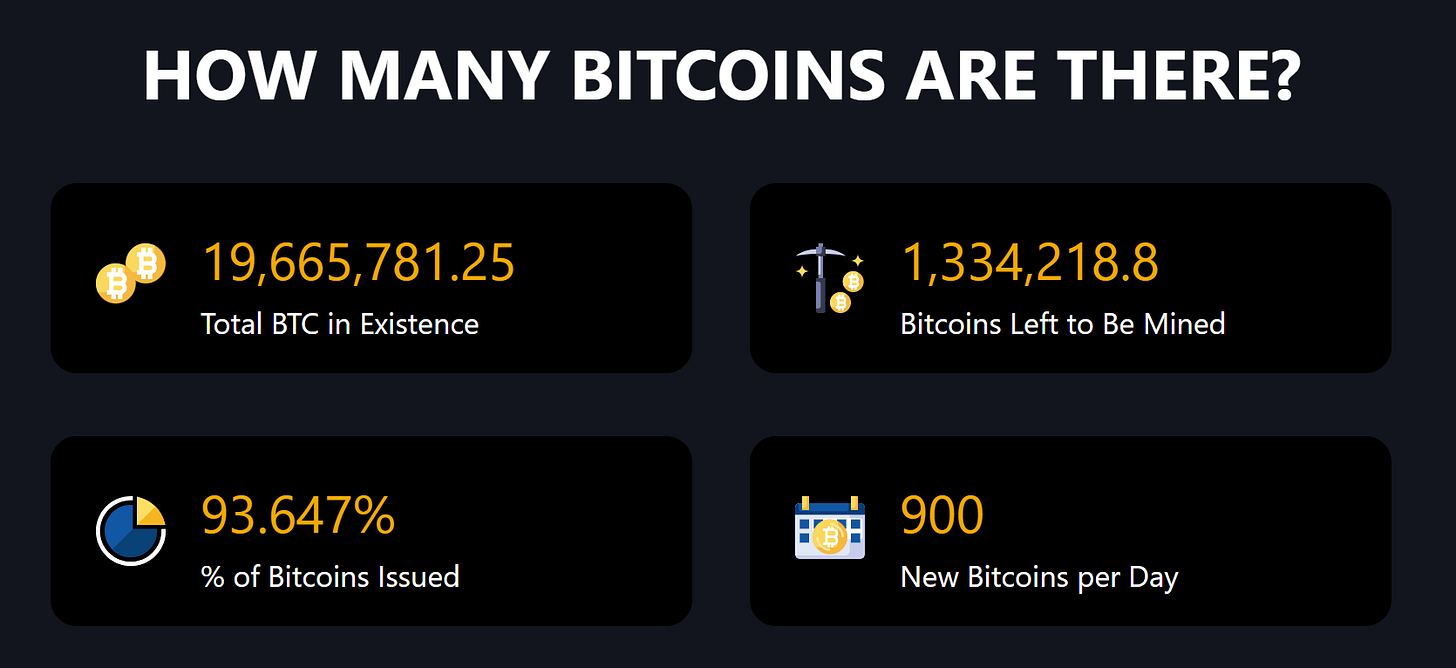

1) 93.6% of bitcoins to ever exist are already in circulation.

Of the 1.3M still left to be produced, the current rate of production is about 900 new bitcoins per day.

2) On April 20th, 2024, the production will be halved to ~450 new coins produced every day.

This event is programmed inside bitcoin, no one can change it, and it happens every 4 years. This will be the 4th halving in bitcoin’s history.

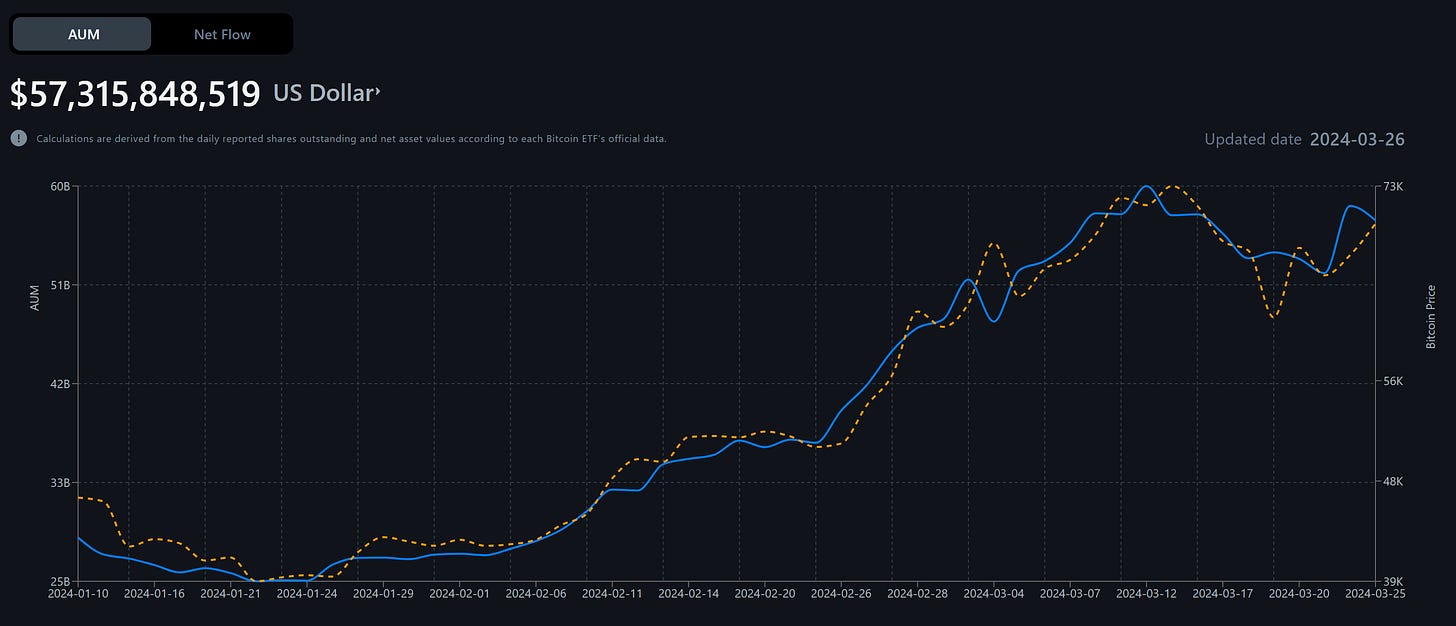

3) The US ETFs have so far purchased for 28B$ of bitcoin.

launched on January 10th, 2024, with 29B$ in assets. Fast forward 7 weeks later, they now have 57B$ (screenshot below). By many, many metrics, the most successful ETF launch in history.

Quick “Napkin” Calculations

Let's keep it real simple:

Napkin #1: since Bitcoin US ETF launch

Since ETF launch, ~900 new bitcoins have been issued every day.

Let’s take an average price of ~55,000$/bitcoin during that period.

900 bitcoins (or think “cars” if you prefer) at 55,000$/car means ~50,000,000$ per day.

That means that:

Every day that more than 50,000,000$ entered the ecosystem, pressure on price increased.

Every day that less than 50,000,000$ entered the ecosystem, pressure on price decreased.

Easy cheesy. Bob is your uncle.

Fact: in the 77 days since launch, US ETFs have added on average 367,000,000$/day. There has been seven time more money entering the ecosystem than what it produced.

And that’s before the halving.

Napkin #2: post halving (crazy scenario)

In April, the number of new coins issued will drop to ~450 per day.

And let’s say that we are crazy and we bring the price of bitcoin up to 100,000$/bitcoin.

That is 50% higher than what it is currently trading at. I am telling you: this second napkin calculation is making us a bit crazy.

450 bitcoins per day at 100,000$/coin means 45,000,000$ per day.

In this scenario:

Every day that more than 45,000,000$ enters the ecosystem, pressure on price will increase.

Every day that less than 45,000,000$ enters the ecosystem, pressure on price will decrease.

Are we good, are you still with me? Is Bob still your uncle?

Now let’s say that we are also crazy and conservative with the ETF inflows, and we cut those by half also. Just for fun. That would mean 185,000,000$/day.

Post halving, if we assume a price of bitcoin 50% higher and ETF inflows 50% lower than where they are today, then the money that will enter the ecosystem will still be four times bigger than what it will produce.

Sometimes on X, people say “you are not bullish enough”.

Bob’s Questions:

Are the US inflows into bitcoin over for now? It doesn’t seem so. We will know in a few days who bought bitcoin ETFs (as per a mandatory filings US residents must complete), but early reports talk of sub 20k averages. This means that fund managers and asset managers have not allocated much yet. Nor have enterprises. Now that they have access to a regulated product, many CFO could start allocating small percentages of their cash to diversify their treasury.

Will there be other sources of inflows into bitcoin? Well, Hong Kong is looking at launching bitcoin ETFs. Crazy, I know! But here are the reports. International enterprises are also signalling their intentions to buy spot bitcoins in a move not dissimilar to what MicroStrategy did.

Departing words

BlackRock and Fidelity are, respectively, the biggest and third biggest asset managers in the world. They are two of the leaders that that made the US Bitcoin ETFs happen.

They are adults. The adults are in the room. The big guys are warmly embracing Bitcoin. The entire world is being told that bitcoin is serious. That bitcoin is to be respected.

What is the impact of that?

How many boomers will now feel comfortable investing 1% of their wealth into bitcoin?

How many investment managers will follow the emerging consensus that Bitcoin is an effective counterbalancer in a portfolio, at somewhere between 2 to 5%?

How many companies around the world will decide to hedge against currency fluctuations by keeping BTC on their balance sheets?

How many countries will follow suit and make it legal tender? Hold bitcoin on their treasury and central banks?